Expectation is the root of all heartache, a proverb that resonates particularly well with Asian refiners at the moment after yet another set of monthly OSPs failed to provide them with the outcome they expected. For many years, the Dubai cash-futures spread could be used as a relatively fireproof gauge of what the forthcoming month’s Middle Eastern OSPs would bring about. Over December, the Dubai M1-M3 backwardation..

eased substantially, with the monthly average lower by $1.65 per barrel, so it was natural that Asian buyers anticipated higher cuts that would roll back Asian OSPs from the multi-year highs seen for cargoes loading in January 2022. Whilst the month-on-month cuts did happen, the average change (around $1 per barrel) reflected the fall in the Dubai structure only partially, potentially providing refiners in Asia with another reason to expand their spot buying, as a recent S&P Platts refiners’ survey seems to insinuate.Chart 1. Saudi Aramco’s Official Selling Prices for Asian Cargoes (vs Oman/Dubai average).

Source: Saudi Aramco.

Several days after OPEC+ once again confirmed its commitment to the 400,000 b/d monthly additions, Saudi Aramco issued its February 2022 official selling prices, setting the stage for other producers. The background against which Aramco did its pricing was relatively favorable – the impact of the rapidly spreading Omicron variant of COVID-19 turned out to be lesser than with previous variants, despite sporadic lockdowns and travel restrictions. Asian demand, in particular, showed no signs of slowing down from the momentum garnered in November-December, and with product inventories at multi-year highs in Singapore and elsewhere, Aramco essentially knew that buying would remain strong. In cutting prices, Saudi Aramco dropped Arab Extra Light the most (-$1.30 per barrel month-on-month, to a $3.20 per barrel premium vs Oman/Dubai) whilst Arab Medium and Super Light saw the smallest cuts, $1 per barrel each, indicating that there was no overarching quality split in the pricing changes.

Chart 1. Saudi Aramco’s Official Selling Prices for NWE Cargoes (vs ICE Bwave).

Source: Saudi Aramco.

The IFAD-set prices for all grades marketed by Emirati national oil company ADNOC also decreased from January 2022, although at a smaller rate. Murban’s February OSP was calculated at $74.36 per barrel, almost $8 per barrel lower than January 2022. Whilst usually benchmark grades would follow supply-demand dynamics, the actual volume of Murban on the market seems to be having an almost invisible impact on actual pricing. The thing is that Murban exports have been decreasing for the straight months already, with December outflows only at 830,000 b/d, and will most probably continue doing so this month, too. On the other hand, the heavier Das and Upper Zakum have been expanding in volume – the latter even became the UAE’s main export stream in December, at 850,000 b/d. This being said, Upper Zakum arguably remains one of the most attractively priced medium sour grades as ADNOC maintains a wide spread between Zakum and the benchmark Murban. Despite having lowered its differential by 10 cents, Upper Zakum is still $1.55 per barrel cheaper than light sweet Murban.

Chart 3. ADNOC Official Selling Prices for February 2022 (set outright, here vs Oman/Dubai average).

Source: ADNOC.

Whilst ADNOC was the first to set its February 2022 OSPs, closely followed by Saudi Aramco, the Iraqi state oil marketer SOMO once again took almost 10 days to publish its official selling prices. In the end, the changes compared to Saudi Aramco were almost non-existent – SOMO decreased Asian prices by $0.9-1 per barrel, whilst Aramco slashed them by $1-1.10 per barrel, though this might be attributed to SOMO already seeing a better refining environment overall. Data on oil product inventories at the UAE’s port of Fujairah, Asia’s second-largest bunkering hub, came out a day before SOMO issued its prices, indicating that middle distillates stocks dropped to their lowest since December 2017. Though SOMO no longer markets the lightest Iraqi grade Basrah Light, which was nevertheless heavy even by Middle Eastern standards, the solid refining margins in Asia insinuated that SOMO could avail itself of the positive pricing environment without triggering the ire of term buyers.

Chart 4. Iraqi Official Selling Prices for Asian cargoes (vs Oman/Dubai average).

Source: SOMO.

Iraq has been increasingly pivoting towards Asian demand, with November-December 2021 exports hitting the highest level since April 2020. India has been increasingly becoming an Iraqi export hotspot – 48% of all December 2021 outflows ended up in the South Asian country (at 1.25 million b/d, Thomson Reuters), consolidating its edge over China, the second-largest buyer. Peculiarly, it is not the usual Basrah Light/Basrah Medium crude that Indian refiners are buying, rather the heavy sour Basrah Heavy, arguably one of the worst quality Middle Eastern grades. As a result of India ramping up its purchases in October-December, Indian refiners now buy 60% of total Iraqi Basrah Heavy exports. Understanding this, SOMO hiked the European Basrah Heavy price by $0.2 per barrel and dropped Asian prices by $1 per barrel, signaling that it would prefer to keep the current split of export directions.

Chart 5. Iraqi Official Selling Prices for European cargoes (vs ICE Brent).

Source: NIOC.

Interestingly, Iraq dropped US-bound prices by 30-35 cents per barrel, even though Saudi Arabia simply rolled over its prices (both SOMO and Saudi Aramco price their American barrels against the ASCI index). With Iraqi exports to the US averaging around 200,000 b/d in the past months, it seems that the intention is to cover more of the American market and reinstate US-bound flows at least partially, now being at a mere one-fifth compared to 2017-2018 levels.

Chart 6. Iranian Official Selling Prices for Mediterranean cargoes (vs ICE Bwave).

Source: NIOC.

Whilst the last weeks of 2021 have seen hopes pick up over the fate of the still-under-negotiation Iranian nuclear deal, with JCPOA members essentially agreeing on the wording of the end document but failing to concur on who does the first conciliatory step, the recent Houthi attack on oil storage facilities in the United Arab Emirates has cooled expectations down. When it comes to February 2022 pricing, Iran’s national company NIOC followed in the footsteps of Saudi Aramco and dropped Iran Light and Heavy by $1.00 and $1.10 per barrel m-o-m to premiums vs Oman/Dubai of $2.00 and $1.00 per barrel, respectively. Iranian crude exports have been picking up steadily over Q4, with vessel-tracking data indicating outflows of some 650,000 b/d. Only half of those cargoes would be going directly to China, the remaining bits would sail somewhere along the Malaysian coast, only to be subsequently trans-shipped to other China-bound ships.

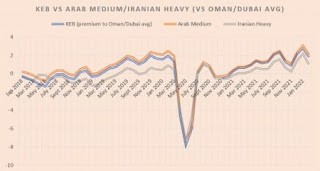

Chart 7. Kuwaiti Official Selling Prices for Asian cargoes (vs Oman/Dubai average).

Source: KPC.

Kuwait, a major exporter that has nevertheless kept all its crude exports in Asia over the course of 2021, has seen its fair share of difficulties lately. For the second time already in less than six months, the country’s main 350,000 b/d capacity Mina al-Ahmadi refinery caught fire, debilitating one of its gas liquefaction plans. It seems that exports will continue unrestricted as this week’s loading schedule is very much in line with previous ones. In terms of pricing, Kuwait remained firmly committed to the Saudi Aramco-mandated market trend, cutting its February 2022 OSPs lower than the changes in the Dubai differential. Mirroring the February move of Saudi peer grade Arab Medium, KEB was decreased by $1 per barrel to a $1.80 per barrel premium vs the Oman/Dubai average.

By Gerald Jansen

Από το oilprice.com

Δεν υπάρχουν σχόλια:

Δημοσίευση σχολίου